In today’s rapidly evolving financial landscape, Fintech applications revolutionize the way we manage money. They streamline transactions, investments, and financial planning. However, their success hinges on something intangible yet foundational: trust in dependable financial technology interfaces.

The Role of Trust and Security in Fintech Applications

Trust is the cornerstone upon which Fintech ecosystems thrive. Did you know that a staggering 85% of consumers express concern about the security of their personal data when using digital financial services? This emphasizes the paramount importance of ensuring robust security measures within reliable, user-friendly financial technology platforms.

Fintech companies handle a trove of sensitive data, from bank account details to investment portfolios. Any breach not only jeopardizes individual finances but also erodes trust in the broader Fintech industry.

UI/UX Strategies: Ensuring Seamless Transactions and Data Privacy

Creating a seamless user experience while prioritizing security is an intricate dance. Imagine this: a well-designed interface that not only looks visually appealing but also guides users through complex financial tasks effortlessly. This is the essence of intuitive UI/UX design in trusted, user-friendly digital finance interfaces.

Paytm, a leading Fintech giant, undertook a transformative journey while launching a B2B service in North America. Collaborating with Idea Theorem, they delved into understanding the complexities of invoice management for businesses. The partnership unveiled critical insights into pain points, ultimately contributing to the successful launch of an intuitive B2B product.

Key Takeaway: This case study emphasizes how close collaboration and deep user research resulted in an interface that intuitively managed invoices and payments, significantly enhancing the user experience while building trust with businesses.

1. Human-Centered Design:

Human-centered design principles lie at the heart of crafting Fintech experiences. It’s not just about functionality but also about understanding the psychology behind user interactions. Elements like color schemes, typography, and even button placements are meticulously considered to enhance user trust and confidence in secure, user-centric financial tech experiences.

2. Cybersecurity Arsenal:

Behind the sleek interface lies a fortress of cybersecurity measures within reliable, secure financial technology systems. Fintech applications employ state-of-the-art encryption techniques, biometric authentication, and machine learning algorithms to detect and prevent fraudulent activities in real-time.

3. Regulatory Compliance:

Ever wondered why Fintech apps ask for your consent multiple times? That’s because they adhere to strict regulatory standards like GDPR, ensuring that user data is handled ethically and transparently within dependable, user-friendly digital finance solutions.

Empowering User Confidence

Building trust goes beyond implementing security features. It’s about empowering users with knowledge and control. Did you know that nearly 60% of consumers abandon a transaction if they feel the checkout process is too complex or lengthy? Streamlining processes is key to retaining user confidence in assured, accessible financial tech interfaces.

Domuso, in its quest to revolutionize apartment rental payments, embarked on a user-centered design journey with Idea Theorem. By understanding user needs and expanding their offerings beyond rent payments, Domuso created a comprehensive platform that addressed multiple pain points for both renters and property managers.

Key Takeaway: Domuso’s case study showcases how understanding user needs and enhancing the overall user experience, beyond just payment solutions, can significantly empower users and foster trust in a Fintech platform.

Trend Analysis in Fintech Security

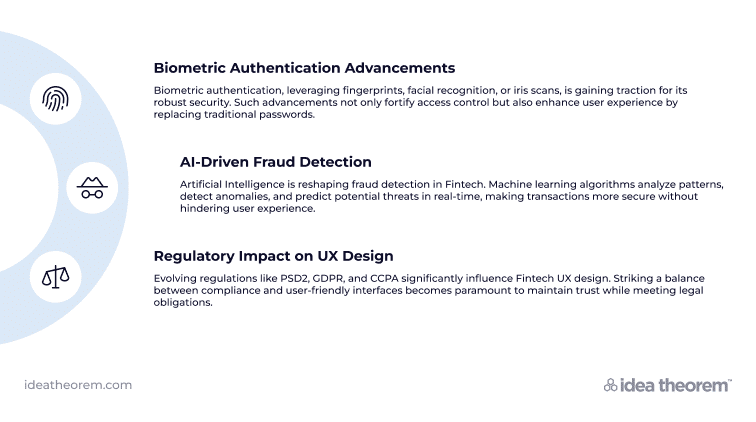

Biometric Authentication Advancements: Biometric authentication, leveraging fingerprints, facial recognition, or iris scans, is gaining traction for its robust security in reliable, intuitive digital finance platforms. Such advancements not only fortify access control but also enhance user experience by replacing traditional passwords.

AI-Driven Fraud Detection: Artificial Intelligence is reshaping fraud detection in secure, user-friendly financial technology ecosystems. Machine learning algorithms analyze patterns, detect anomalies, and predict potential threats in real-time, making transactions more secure without hindering user experience.

Regulatory Impact on UX Design: Evolving regulations like PSD2, GDPR, and CCPA significantly influence Fintech UX design. Striking a balance between compliance and user-friendly interfaces becomes paramount to maintain trust while meeting legal obligations in trustworthy, adaptable financial technology experiences.

User Education for Enhanced Security Awareness

Tips for Users: Educate users on safeguarding their data by advising them to use strong, unique passwords, enable two-factor authentication, regularly update applications, and avoid sharing sensitive information via unsecured channels within reliable, secure digital finance frameworks.

Checklist for Security: Provide a checklist guiding users on verifying app permissions, reviewing transaction history regularly, setting up alerts for unusual activities, and reporting suspicious behavior promptly in assured, user-centric financial tech platforms.

Best Practices for Fintech UX Designers

Prioritize Accessibility: Design with accessibility in mind by ensuring compatibility with screen readers, providing alt text for images, and allowing for font adjustments, ensuring an inclusive experience for all users in trustworthy, adaptable digital finance solutions.

Constant User Feedback: Incorporate user feedback loops and usability testing to iterate and improve the UX continually in reliable, intuitive financial technology environments. Understanding user behavior and preferences is crucial for designing intuitive and secure interfaces.

Ethical Framework in Fintech

Transparent Data Handling: Upholding ethical standards involves transparently communicating how user data is collected, stored, and utilized in trustworthy, adaptable financial technology ecosystems. Providing clear terms of service and privacy policies instills confidence in users regarding their data’s ethical treatment.

User Consent: Emphasize the importance of obtaining explicit user consent for data collection and processing in secure, user-friendly digital finance interfaces. Respecting user choices and allowing easy opt-out options reinforces trust and ethical data practices.

The Evolution of Fintech Trust

As Fintech continues to evolve, the symbiotic relationship between trust, security, and user experience becomes more pivotal. Personalization, proactive communication, and an unwavering commitment to security form the bedrock of sustainable user trust in reliable, adaptable financial technology frameworks.

In conclusion, bridging the gap between innovation and user trust is the ultimate goal in assured, user-friendly digital finance solutions. By harnessing cutting-edge technology within a user-centric framework, Fintech companies can instill confidence, empower users, and revolutionize the financial landscape.

Ready to explore the seamless world of trustworthy, adaptable financial technology ecosystems? Join us on this journey where trust meets technology, and experience a financial realm where confidence reigns supreme.

—

What’s Next

Idea Theorem is an award-winning design & development agency based in North America. Through our empathy-driven approach, we have crafted digital products that have positively impacted over 10 million users. Our mission is to shape the digital future by delivering exceptional experiences. Contact Us if you have any questions; we will gladly help you.